dc auto sales tax

Rates are available by city grouped by county alphabetical by city and in Excel or QuickBooks file format. The excise tax is expected to be revised in 2021.

What States Charge The Least Most In Car Taxes Carvana Blog

1101 4th Street SW Suite 270 West Washington DC 20024 Phone.

. Effective October 1 2011 the District of Columbia sales and use tax rate applicable to gross receipts from the sale of or charges for the service of parking or storing motor vehicles or trailers has been increased from 12 percent to 18 percent. Spirituous or malt liquors beers and wine sold for off-premises consumption by certain the Alcoholic Beverage Control Board licensed vendors are subject to the 10 sales and use tax rate. The District offers a tax exemption for EVs and high efficiency vehicles.

Ask the Chief Financial Officer. Effective October 1 the Washington DC Office of Tax and Revenue increased the sales and use tax rate to 1025 from 1000 for leased vehicles. Masks are still required at DC Gov facilities with direct interaction between employees and the public.

DC DMV Service Update. Special reporting instructions for sales or leases of motor vehicles. For more information visit the FAQ page.

As of February 1 the vehicle excise tax structure in the District of Columbia has changed somewhat in order to comply with the CleanEnergy DC Omnibus Amendment Act of 2018 which took effect at the beginning of the month. New Sales and Use Tax Rates Effective October 1 Friday September 30 2011 Washington DC - Effective October 1 an increase in the District of Columbia Sales and Use tax will apply to the following tax types. Walk-in service has returned to DC DMV for all Service Centers and Adjudication Services.

The updated excise tax rates will take into account the fuel efficiency of motor vehicles as mandated by Title V of the CleanEnergy DC Omnibus amendment Act of 2018. However some used car dealerships and all private sellers will require you. The motor vehicle saleslease tax also applies when use tax is due on demonstration executive and service vehicles.

A sales tax of 6 percent is charged on the MSRP of any new vehicle purchased in Washington DC. Sales tax details The Washington DC sales tax rate is 6 effective October 1 2013. The District of Columbia state sales tax rate is 575 and the average DC sales tax after local surtaxes is 575.

Sales and Use Taxes. In addition there are also four tiers of excise taxes levied against a new car or truck. Determine the location of my sale Sales tax collection is based on the location where the customer receives the merchandise or service destination-based sales tax.

Motor vehicles with fuel economy in excess of 40 mpg including EVs are eligible for an exemption for paying the vehicle excise tax. 1101 4th Street SW Suite 270 West Washington DC 20024 Phone. How to buy and sell a vehicle in the District.

The District of Columbia collects a 6 state sales tax rate on the purchase of all vehicles that weigh under 3499 pounds. Do not use the sales tax forms to report and pay the gross receipts tax. Three are based on the same weight classes as the registration fees and come out to 6 7 and 8 percent of the fair market value of the vehicle respectively.

Under the new guidelines only fully electric vehicles are exempt from the excise tax as applied to new-car purchases and. Acting Chief Financial Officer-A A. The excise tax is expected to be revised in 2021.

Title 25 Chapter 9. If EITC is applied to the excise tax documentation from the Office of Tax and Revenue OTR will be required prior to vehicle titling. Parking The tax on services for parking or storing motor vehicles or trailers will increase from 12 percent to 18 percent.

RCW 82144504 provides an exemption from the public safety component of the retail sales tax approved by voters in a city or county. District of Columbia has a higher state sales tax than 788 of states Washington DC recently lowered the district sales tax by a quarter of a percent from 6 to 575. Motor Vehicle Excise Tax.

While tax rates vary by location the auto sales tax rate typically ranges anywhere from two to six percent. A tax rate of 7 is charged if the vehicle weighs between 3500 and 4999 pounds and 8 is charged for vehicles that weigh at least 5000 pounds. Current Tax Rate s Beer 279 per barrel Champagnesparkling wine 045 per gallon Distilled Spirits 150 per gallon Light wine alcohol content 14 or less 030 per gallon Heavy wine alcohol content above 14 040 per gallon Cigarettes The sale or possession of cigarettes in the District.

Individuals who qualifiy for the District earned income tax credit EITC may elect to pay by weight class 6 7 8 or the MPG adjusted tax benchmarkschedule depending on lowest costs. This is a single district-wide general sales tax rate that applies to tangible personal property and. For the most accurate sales tax rate use an exact street address.

The District of Columbias sales tax is imposed on all sales of tangible property as well as on certain services. Inspection if there is an existing valid DC inspection at the time the vehicle is registered then it will be transferred to the new vehicle owner for no charge Excise tax if there is no change in vehicle ownership ie you are transferring a vehicle into DC from another jurisdiction then no excise tax is due Organization tags Registration. Effective October 1 the Washington DC Office of Tax and Revenue increased the sales and use tax rate to 1025 from 1000 for leased vehicles.

These changes become effective on February 1 2021. Please adjust your systems accordingly. In 2019 the median excise tax per vehicle purchase was 680.

The updated excise tax rates will take into account the fuel efficiency of motor vehicles as mandated by Title V of the CleanEnergy DC Omnibus amendment Act of 2018. Please continue to wear your mask at all DC DMV facilities. Motor Vehicle Fuel Taxes.

Download the latest list of location codes and tax rates. For assistance with MyTaxDCgov or account-related questions please contact our e-Services Unit at 202 759-1946 or email e-servicesotrdcgov 815 am. In recognition of Memorial Day all DC DMV locations will be.

Most new car dealerships will collect the excise tax in addition to the registration fees and take all the necessary steps to have the vehicle titled and registered on your behalf. As a result of recent regulatory changes DC DMV has revised the calculations for motor vehicle excise taxes.

Sales Tax On Cars And Vehicles In District Of Columbia

Virginia Sales Tax On Cars Everything You Need To Know

Nj Car Sales Tax Everything You Need To Know

Dc Motors Used Cars Northwood Oh Used Bhph Cars Oregon Oh Bad Credit Car Dealer Northwood Oh Pre Owned Bhph Autos Oregon Oh Previously Owned Vehicles Northwood Oh Used Suvs Oregon Oh Used Bhph Trucks Northwood Oh Used

With Used Car Values Up Some Northern Virginians Get Car Tax Relief Wtop News

How Do State And Local Sales Taxes Work Tax Policy Center

Do You Have To Pay Taxes On Your Car Every Year Carvana Blog

How Long Does It Take To Charge An Electric Car Shopping Guides J D Power

Which U S States Charge Property Taxes For Cars Mansion Global

States With No Sales Tax On Cars

Can I Avoid Paying Sales Taxes On Used Cars Phil Long Dealerships

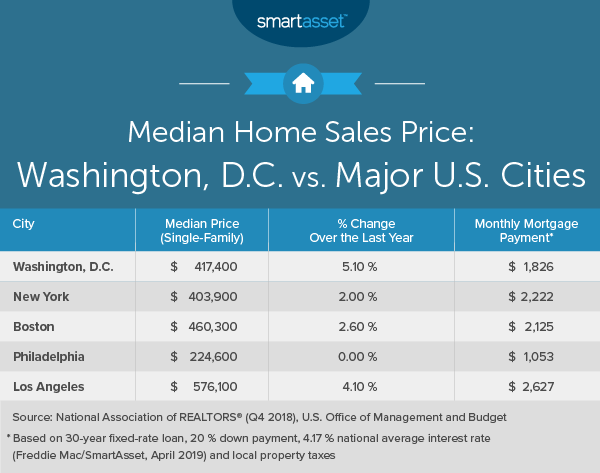

The Cost Of Living In Washington D C Smartasset

Used Cars Under 1 000 For Sale In Washington Dc Vehicle Pricing Info Edmunds

My Vehicle Title What Does A Car Title Look Like

Are Car Repairs Tax Deductible H R Block

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist